In our previous blog post we briefly mentioned when a UPI will be necessary to comply with the EU EMIR-REFIT. Here we will show you how to generate or retrieve a UPI from the ANNA-DSB. This article goes beyond EU EMIR – REFIT as the same modalities presented below can be applied to all jurisdictions that have endorsed the UPI, including, but not limited to, the USA, the UK, Australia, the EU, Singapore, etc.

UPI inputs

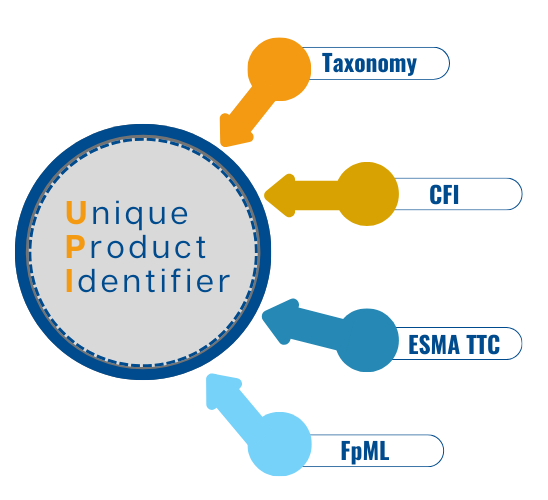

In order to achieve harmonisation across jurisdictions and streamline inputs, the UPI standard has adopted variable standards widely used in the financial industry. A few of these inputs include:

- ISDA’s taxonomy ver.2 for the categorisation of products;

- CFI codes ISO standard 10962 ver.2015 for the classification of products;

- ESMA’s Transparency Calculations (TTC) for equity indices;

- ISDA’s FpML for commodity definitions and interest rates;

- Etc.

To correctly generate or retrieve the UPI code, market participants need to familiarise themselves with these inputs to avoid generating or retrieving incorrect UPI code

ANNA-DSB has produced a library of product definitions for the UPI where market participants will find all necessary information contained therein.

UPI generation/retrieval

In order to be allowed to generate UPIs, the ANNA DSB requires interested parties to sign up to its service and pay a fee correlated to the amount of UPIs said parties need to generate on a yearly basis. In the case where the interested party is only looking to retrieve already issued UPIs, the ANNA DSB service offers a free registration option that has some limitations.

The UPI, as we shall see, is issuer agnostic. That means that the UPI is not attached to the entity that generated it. Hence, where an entity has generated a UPI with specific attributes, for example, a Non-Deliverable Forward on EURUSD where the settlement currency is the EUR, another entity offering the same deliverable forward with the same attributes can retrieve the UPI previously issued for its reporting needs.

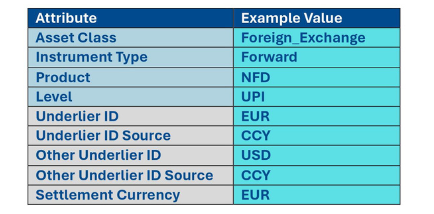

The UPI request template describing the various attributes that the interested party needs to provide to issue the correct UPI can be found in the product libraries linked above. In our example, we will show you what values need to be inserted for a NDF on the EURUSD and settled in EUR. The ANNA-DSB systems will request the following items in order to generate the UPI.

Therefore the system will require to identify the following parameters, in parenthesis the source for each input.

- Asset Class = Foreign_Exchange (ISDA Taxonomy);

- Instrument type = Forward (ISDA Taxonomy);

- Product = NDF (ISDA Taxonomy);

- Level = UPI (ANNA DSB);

- Underlier ID = EUR (ISO 4217 – currency 3 letter code);

- Underlier Source = CCY (ANNA-DSB);

- Other Underlier ID = USD (ISO 4217 – currency 3 letter code);

- Other Underlier ID Source = CCY (ANNA DSB);

- Settlement Currency = EUR (ISO 4217 – currency 3 letter code).

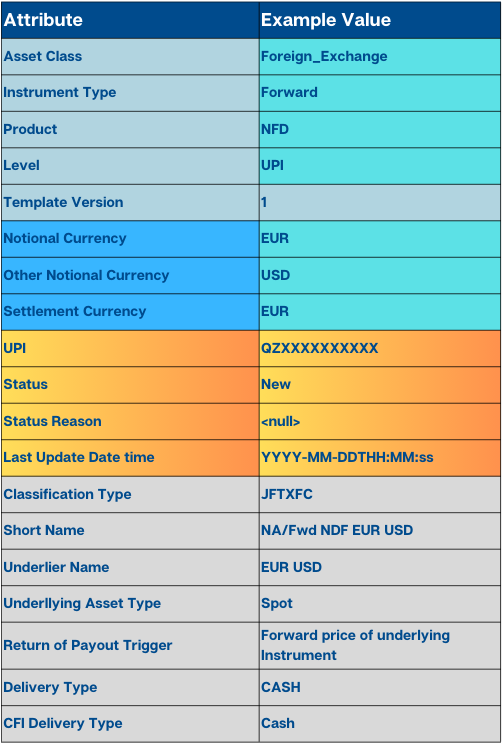

The system will generate the UPI. The UPI will contain the inputs the generating entity inserted but will also contain derived values generated from ANNA DSB such as the instrument’s name, the CFI, and other characteristics.

As we can see from the output, the instrument is issuer agnostic, i.e. there is nothing in the UPI that ties this specific UPI with the entity that issued it. Where another entity trades with NDFs on EURUSD settled in EUR, they can use this previously issued UPI for their reporting needs. Moreover, the above record will be publicly available to all registered users to the UPI service, including, but not limited to, regulators who can cross check the reported values (e.g. CFI, instrument name, settlement currency, etc.) with the UPI contained values used to verify a correct submission.

Attention

From the above example we would like to draw the attention of UPI generating or retrieving entities to the following:

- Ensure familiarity with the mentioned inputs

- When using an already issued UPI, ensure that the product you intend to trade matches 100% all the UPI attributes relevant to the product.

- Familiarise yourself with ANNA-DSB’s production and testing environment for UPIs.

How is MAP FinTech going to assist?

MAP Fintech offers the UPI Link Service that helps retrieving companies match their products’ attributes precisely to those already issued UPIs, ensuring that reporting companies use the correct UPI Code.

MAP FinTech’s UPI Link Service boasts essential functionalities, including:

- Automated identification of UPIs using reference data provided by the reporting entity and the latest issued UPIs supplied by the ANNA-DSB.

- UPI enrichment of reported files prior to submission to the TR.

- Error identification where UPIs cannot be mapped against the ANNA-DSB’s issued UPI records.

- Inline editing capability for on-the-fly amendments on the UPI.

- Advanced search function from within Polaris portal which can pinpoint the exact UPI based on enhanced search criteria.